Understanding Material Irregularities

According to the PAA, a material irregularity means any non-compliance with, or contravention of legislation, theft or a breach of a fiduciary duty identified during an audit. These irregularities can result in significant financial loss, misuse of public resources, or substantial harm to public sector institutions or the general public.

At a standing committee meeting held by the Auditor General (AG) on 08 March 2023, it was reported that the 266 MIs on non-compliance and suspected fraud had the following impacts:

- 240 Material financial losses, estimated at R14.34 billion.

- 9 Misuses of material public resources.

- 3 Instances of substantial harm to the general public.

- 14 Instances of substantial harm to the public sector institutions.

Regrettably, no action has been taken on 82% of these MI’s.

Source: Material Irregularities in National and Provincial Government (PFMA): AGSA briefing | PMG

Responding Appropriately to Material Irregularities

The Responsibility of the Accounting Officer

Upon receiving communication regarding an MI, the accounting officer must respond in writing, addressing the MI and providing any necessary supporting documents.

Importance of Addressing MIs Appropriately

- Ensures the AG determines if proper actions were taken, improving the municipality’s audit report.

- Prevents the MI from being escalated to a public body for further investigation.

- Failure to respond appropriately by the specified date may lead the AG to assume that adequate measures are not being taken.

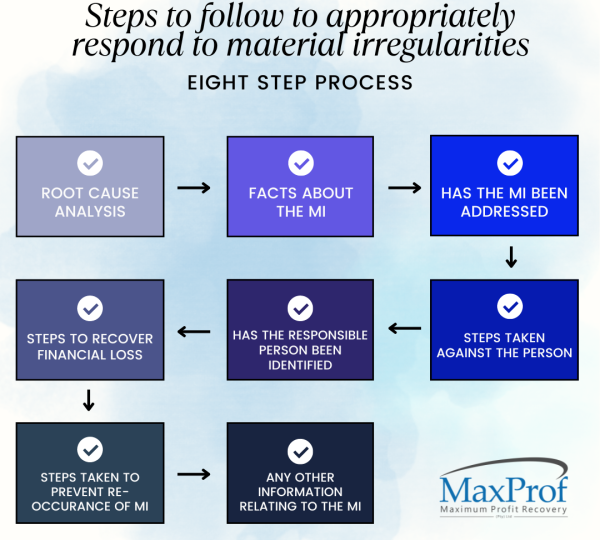

Steps to Follow in Responding to MIs

Financial Losses Related to VAT and PAYE

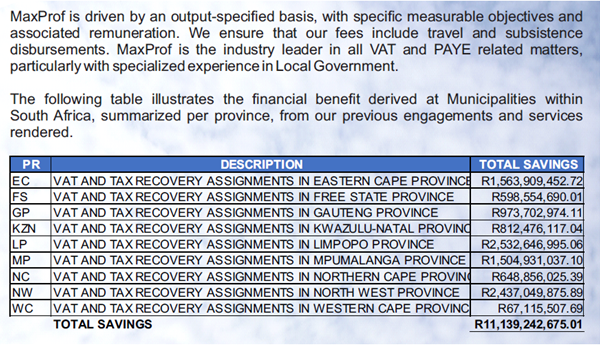

MaxProf conducted research across different provinces to identify potential losses within the VAT and PAYE functions. The findings highlight significant areas of concern and potential financial recovery.

Conclusion

Material Irregularities (MIs) have far-reaching impacts beyond financial losses; they affect social development and revenue generation for municipalities, ultimately hindering their service delivery mandates. Preventing and resolving MIs requires municipal leaders to engage with service providers like MaxProf or collaborate with institutions such as SALGA and AGSA. Addressing MIs proactively can prevent drastic measures and foster a more transparent and accountable governance structure.

Key Insights from Participants:

- Lack of Municipal Engagement: A major factor leading to MIs is the lack of proactive engagement from municipalities, delaying the resolution of irregularities.

- Insufficient Evidence: Municipalities often fail to provide adequate evidence, complicating the AG’s ability to address MIs.

- Avoiding Escalation: AGSA prefers resolving MIs without escalation, emphasizing the importance of proper and timely responses.

- Duty of Municipalities: Municipalities must engage with AGSA, providing clarity and cooperation to ensure accurate understanding and resolution of issues.

- Complex Regulatory Environment: Navigating the complexities of municipal legislation and ensuring compliance is crucial in responding to MIs effectively.

For more information and related articles, visit our MaxProf Media Page.