What are VAT compliant invoices, and how do they affect your business?

If you are a South African business, we understand how VAT can get confusing and how it can affect your company’s cashflow if not done correctly.

Many businesses forfeit their VAT savings because their supplier or vendor invoices are not complaint with the South African Revenue Services (SARS) requirements. Not having the right professionals handling your VAT matters can cost you big time, and after a couple of years this can accumulate to millions in losses.

Besides unclaimed VAT, your company claims may be disallowed by SARS for avoidable mistakes such as a missing VAT number or address.

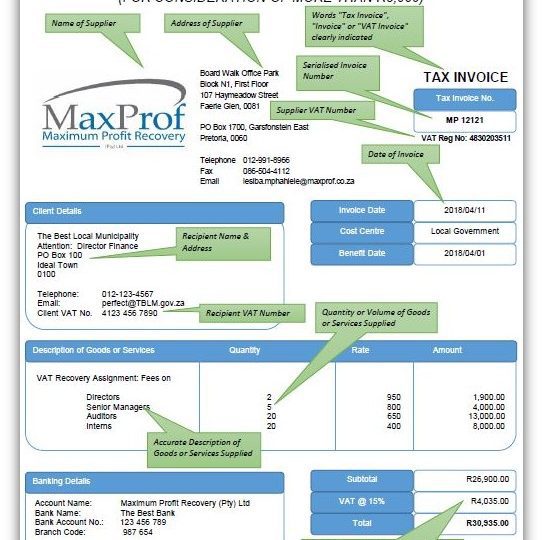

So, what small changes can you make to your TAX invoices to avoid Non-Compliance?

MaxProf gives a few tips of how your business can avoid classic TAX invoice mistakes. Refer to the example below.

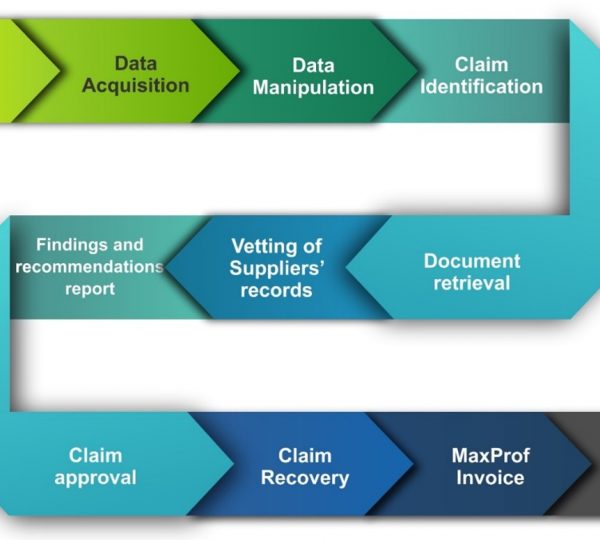

MaxProf’s Account Payable process

It does not end there; more can be done to ensure that we maximise your profits. MaxProf offers Accounts Payable services which include the following areas to be investigated:

- Review to be performed for the past three financial years.

- Document the processes followed for all Accounts Payable transactions.

- Identify possible erroneous and / or problematic Accounts Payable transactions in the organisation’s financial systems.

- Isolate and investigate the transaction(s) to be recovered from suppliers.

- Submit a recovery report including all supporting schedules and documentation.

- Recover the amount(s) identified from the respective suppliers.

- Training and skills transfer.

Process Flow